Valuation Services

Our Valuations Offering

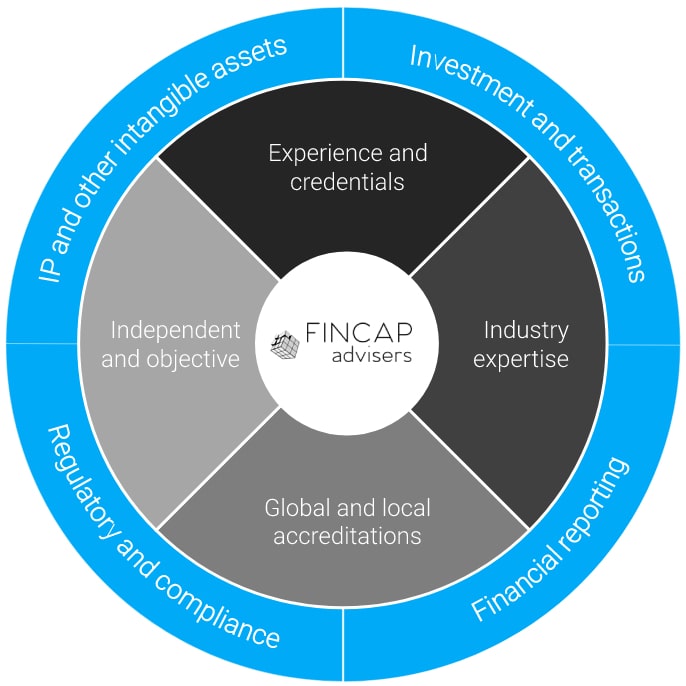

Our team has a combined valuation experience of 40+ years with national and multi-jurisdictional experience across multiple industries, ready to provide a combination of technical know-how, market insight and transaction experience.

Today’s leading organisations are seeking to unlock greater value from:

- Existing assets and ongoing capital expenditure; or

- New acquisitions, investments and complex corporate arrangements

Regulators and tax authorities are demanding greater transparency of fair/market value measurements.

The above, combined with the uncertainty and inherent complexities caused by the COVID-19 pandemic, require the attention of an experienced commercial valuations team.

FINCAP Corporate Advisory Team

- We provide independent and reliable opinions on the value of your business, shares, intangible assets and other financial assets.

- We hold international professional accreditations

- We have extensive valuation experience in various industries with knowledge of local and international regulatory marketplaces.

- We offer an integrated approach to measure and analyse a business’ value drivers and address a broad range of valuation aspects.

Sell-side Advisory Services

FINCAP is capable to provide a full range of services required for a successful fundraising. This allows our clients to

maintain control, develop a negotiation strategy and avoid potential delays.

- Planning

- Pre-marketing

- Marketing to Buyers

- Evaluation of investor interest

- Negotiation and closing

How we can support you

- Engage with management to work through financial projections and business plan

- Support in determining the offer price

- Develop indicative price range

- Assist in decision on floor price

- Assess key impacts to valuation

- Identify potential deal breakers

Output

- Review of the management business plan

- Condensed report on initial price consideration

How we can support you

- Discuss and agree on the sale structure and strategy in order to select an appropriate sale process

- Prepare marketing documents such as

- Teaser

- Information Memorandum

- Develop long / short list of potential investors

- Prepare Process letter and Non Disclosure Agreement (“NDA”)

Output

- Marketing materials

- Long list of investors

- NDA and Process letter

How we can support you

- Approach potential buyers and circulate Teaser

- Execute NDAs with potential buyers and distribute Information Memorandum

- Facilitate and manage investors meetings /communication with the management of the company

- Assist in the preparation of the management presentation

- Receive expressions of interest and evaluate indicative offers

Output

- Management presentation

- Non-binding offers

How we can support you

- Participate and support in the negotiations

- Facilitate and coordinate due diligence/data room access/exchange of information

- Respond to buyer due diligence requests and schedule follow-up meetings

- Organise management presentations

- Receive final offers, evaluate and obtain any clarifications

Output

- Due diligence

- Final binding offers

How we can support you

- Evaluate the final offers

- Coordinate authorised release of commercially sensitive data

- Coordinate Share Purchase Agreement (“SPA”) preparation, advise on financial terms of the SPA

- Coordinate all parties involved in the transaction (e.g. lawyers, representatives of the potential investor, etc.)

- Coordinate SPA signing and deal closing

Output

- Commercial review of SPA

- Deal closing

Buy-side Advisory Services

Our integrated approach ensures an early identification of key potential financial and operational issues and leaves room to prepare a negotiation strategy required for a successful acquisition.

- Strategy formulation

- Planning and analysis

- Due diligence

- Bidding and negotiation

- Transaction closing

How we can support you

- Establish relationship with the Target’s stakeholders and secure access to information

- Assist in formulating overall transaction strategy and bidding tactics

- Identify potential deal breakers, process drivers and challenges

- Evaluate and review all available information and documents with regards to the Target and the sale process

Output

- Condensed report on potential red flags / deal breakers

How we can support you

- Engage in early discussions with the Target’s management to understand strategic rational and stakeholder analysis

- Support in determining the offer price

- Develop an indicative price range

- Assess key value drivers including key areas of revenue and cost synergies

- Support in drafting the Non- Binding Offer (“NBO”)

Output

- Condensed report on initial price consideration

- NBO

How we can support you

- Assist in the appointment of advisers/specialists for the legal, tax and technical due diligence process

- Establish the scope of work with the Client’s advisers and determine the reporting deadlines

- Perform financial due diligence of the Targe

- Coordinate data room access among all transaction team members

- Manage and coordinate Q&As and overall due diligence work

Output

- Due diligence

How we can support you

- Incorporate the due diligence outcome into the valuation exercise

- Assist the Client in developing Binding Offer

- Formulate proposal (pricing, transaction structuring, etc)

- Draft and submission of Binding Offer

- Support in negotiations of key Sale Purchase Agreement (“SPA”) and Shareholders Agreement terms

- Price review and adjustment based on feedback received

Output

- Condensed report on final price consideration

- Binding offer

- SPA

How we can support you

- Assisting in drafting of SPA and Shareholders’ Agreement

- Negotiation of final Vendor warranties and Buyer obligations

- Preparation and submission of regulatory documentation and approvals

- Agreement on closing date, accounts and audit completion

- Assistance with any post- completion work related to the SPA

Output

- Commercial review of SPA and

- Deal closing